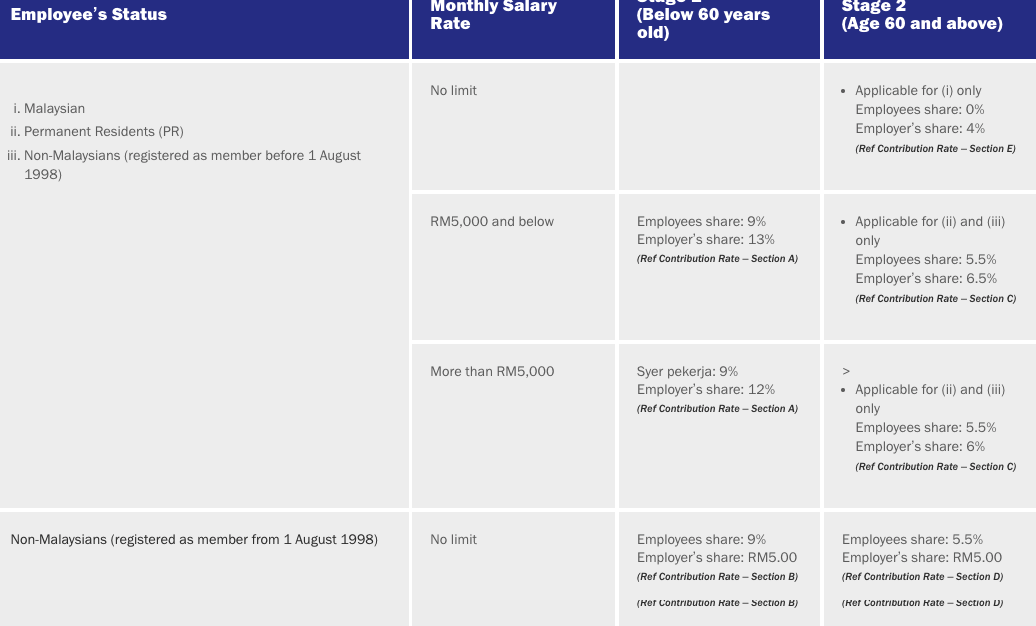

Wages up to RM30. At the same time the employees share of minimum contribution rate has been reduced to 0 down from the previous 55.

Epf Calculator How To Calculate Pf Amount For Salaried Employers

KUALA LUMPUR Jan 7.

. January 07 2019 1604 pm 08. The new rates will commence with Malaysian workers January 2019 pay in time for the February 2019 contribution. RATE OF CONTRIBUTION FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 001 to 1000 NIL NIL NIL From 1001 to 2000 300 200 500 From 2001 to 4000 600 300 900 From 4001 to 6000 800.

Sun Mar 24 2019. Contribution By Employer Only. The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable public sectors as well as voluntary contributions by those in the informal sector.

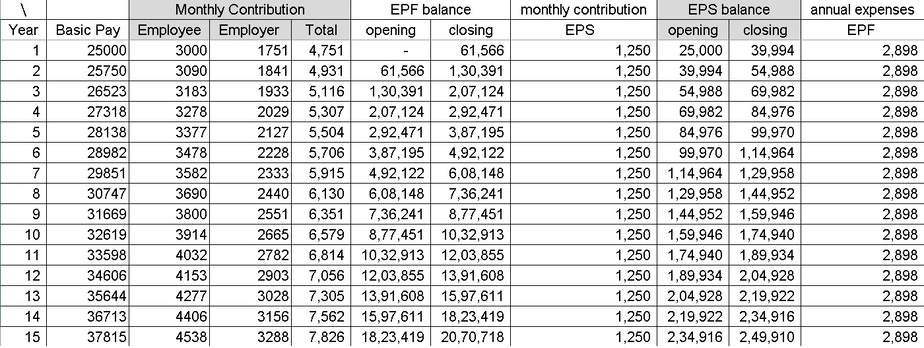

Table below gives the rates of contribution of EPF EPS EDLI Admin charges in India. If an employees salary below rm 5000 the employer contribution rate will automatically be set at 13. UNDER EPF The contributions are payable on maximum wage ceiling of Rs.

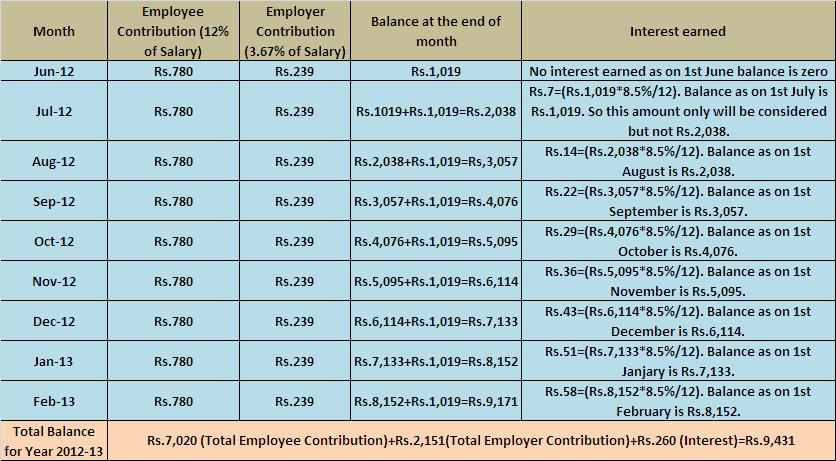

For example in countries like Greece that taxation goes all the way up to 22 which means that a lot of people are actually paying up to. From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme. For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13.

To pay contribution on higher wages a joint request from Employee and employer is required Para 266 of EPF Scheme. For the salaried employee with the EPF contribution rate of between 7 to 11 employee and 12 or 13. What are the contribution rates for epf.

The new minimum statutory rates will start. Can an employee opt out from the Schemes under EPF Act. Every country out there has different rules when it comes to the amount of taxes people pay for multiple different things.

For employees who receive wagessalary exceeding RM5000 the employees contribution of 11 remains while the employers contribution is 12. In early 2019 I registered myself for EPF i-Saraan previously known as 1Malaysia Retirement Savings Scheme or SP1M. Meanwhile the employees contribution rate for EPF.

The minimum employers share of the Employees Provident Fund EPF statutory contribution rate for employees aged 60 and above has been reduced to 4 per month. 00 should the. 15000- The employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate.

Employee Contribution EPF12 200002400 Employer Contribution EPS833150001250 Difference2400-12501150 Total Employer PF125011502400 Note- Even if PF is calculated at higher amount For EPS we will take 15000 limit only Remaining amount wil go to Difference. KUALA LUMPUR 7 January 2019. From my understanding the difference between the scheme and i-Saraan or Kasih Suri Keluarga Malaysia is as below.

What Is Pf And Why Is It Mandatory. Employer contribution Employee provident fund AC 1 12. This was announced by the EPF also known as KWSP Kumpulan Wang Simpanan Pekerja on 7 January 2019 Monday.

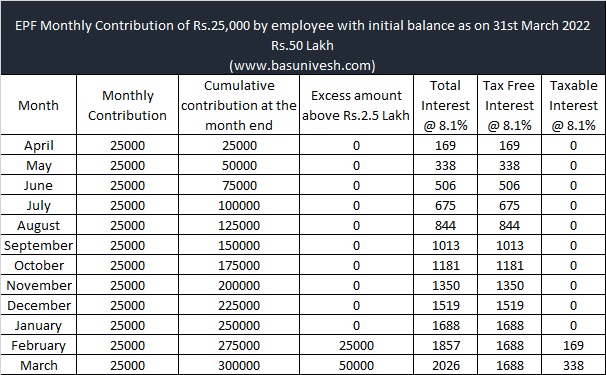

By noticing this trend you have to still have a big relief that you are under the second-highest interest rate group currently as the EPF Interest Rate 2019 2020 is 85. Epf contribution rate 2019-20. C employees who are not malaysian citizens who have elected to contribute before 1 august 1998.

When wages exceed RM30 but not RM50. - A A. Meanwhile the employees share of contribution for this age group is set at zero the EPF said in a statement today.

Dated 28th february 2019 the contribution shall be calculated on the basis of monthly. If you check out the historical EPF contribution rate it increased a lot from around 625 in 1956 to currently at 12 of BasicDA. January 2 2019 at 343 pm.

KWSP - EPF contribution rates. Effective from 2019 the minimum employers contribution rate of EPF for employees aged 60 and above has been reduced to 4 per month. AMOUNT OF WAGES RATE OF CONTRIBUTION FOR THE MONTH FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 52001 to 54000 7100 6000 13100 From 54001 to 56000 7300 6200 13500 From 56001 to 58000 7600 6400 14000 From 58001 to 60000 7800 6600 14400.

The Employees Provident Fund EPF announces that the minimum Employers share of EPF statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four 4 per cent per month while the Employees share of contribution rate will be zero per cent. Sir EDLIS Administrative charges waived from 01042017 Please refer the attached link 15th March 2017. Employers contribution towards Employees Deposit-linked Insurance Scheme is 050 and the administrative charges are 050.

Previous employers EPF contribution rate was 6 per month for employees aged 60 and above while employees were required to contribute 55.

Would Multimillionaire Epf Savers Help Poorer Members The Edge Markets

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

20 Kwsp 7 Contribution Rate Png Kwspblogs

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

Epf Change Of Contribution Table Ideal Count Solution Facebook

Epf Kwsp Dividend Rates 2019 Otosection

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

20 Kwsp 7 Contribution Rate Png Kwspblogs

Epf New Employee Minimum Statutory Contribution Rate On Ya2021 Yau Co

What Is The Epf Contribution Rate Table Wisdom Jobs India

Kwsp Epf Sets Rm228 000 As Minimum Target Savings At Age 55

Epf Kwsp Dividend Rates 2019 Otosection

How Epf Employees Provident Fund Interest Is Calculated

New Epf Taxation And Tds Rules Contributions Above Rs 2 5 Lac Basunivesh